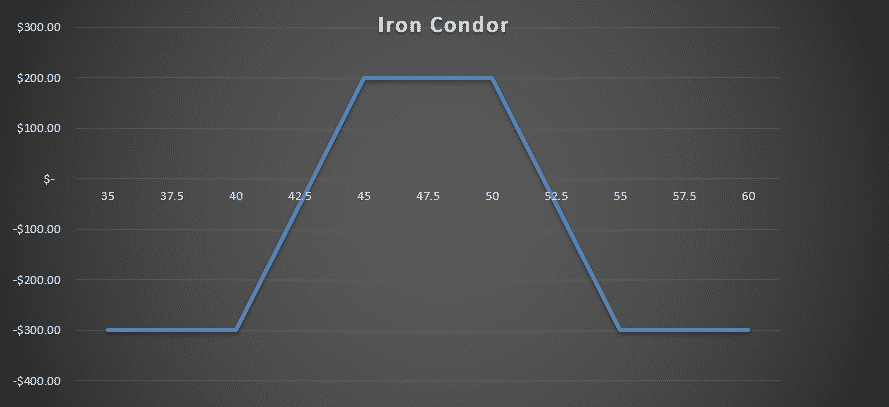

We collected $0.30 per share or $30 per contract in our example above. The total profit potential of an iron condor is the credit received when entering the trade. The maximum risk that a trader can incur is the difference in strike prices of the short strikes, less the net credit received. It is defined as a risk instead of an undefined risk (such as writing naked options) and provides a perfect reward to risk ratio. An iron condor consists of two vertical spreads – a bull put spread and a bear call spread. What Are the Advantages of the Iron Condor Options Strategy? If you think volatility will decrease, move your short spread closer to market value (ITM). If you think volatility will increase, roll your short spread away from market value (further OTM). A trader may move this strategy up or down depending on where you think the underlying security will trade from expiration to expiration.

The breakeven points are located at the lower and upper strikes plus/minus the net debit paid for both spreads.Ī trader can adjust the iron condor by rolling one or both spreads to different strikes before expiration. The maximum loss equals the premium paid for both spreads (the distance between strikes minus the net credit received). The maximum profit is achieved if the underlying security closes at or near the strike price of the short option at expiration. When this happens, both contracts expire worthlessly, and you keep the total credit you received for entering the trade.

The strike prices of the options should also be equidistant from the current price of the underlying stock (i.e., both options are at the money). The strategy involves selling two options contracts (puts and calls) with different strike prices but with the same expiration date. The loss is limited to the difference between strike prices, less premium for placing on trade, or debit paid for putting on a business. The maximum gain is limited and occurs when the underlying stays above the long puts, a lower strike, and a higher strike at the end below the long calls. The iron condor trader expects the underlying to remain within a specified range until expiration. Specifically, you could sell an iron condor. This belief can lead to a strategy that profits from SPX staying within a defined range. You expect the range trading to continue until some significant catalyst emerges to create a breakout from the range. You think this because it has recently been trading in a narrow range, with relatively low volatility. You believe that the S&P 500 Index (SPX) will trade in a range for the next several weeks. At the same time, they also need to buy an out-of-the-money put option and sell an out-of-the-money put option of a lower strike with the same end. To implement this strategy, the investor needs to buy an out-of-the-money call option and sell an out-of-the-money call option of a higher strike with the same expiration. What is the Iron Condor Options Strategy? This article will discuss the iron condor options strategy and its advantages. In this case, you could either close out your position early and accept a loss or hold on until expiration and suffer potentially much more significant losses. High volatility makes an iron condor more expensive because there's a greater possibility that the underlying stock will move outside the range you set for your iron condor trade. A put iron condor would be structured the same way using puts instead of calls. We will look at an example below using a call iron condor. That's why it's considered a "condor" because, with four different strikes, it looks like a bird with wings spread out getting ready to fly. The option strategy involves the simultaneous purchase and sale of either out-of-the-money (OTM) calls or puts of the same underlying security and expiration date. This means the investor doesn't have to view whether the market will go up or down they only need to identify a range where they believe the stock price will be by the expiration of the options contract. As volatility increases or decreases, the value of iron condor changes - sometimes significantly.Īn iron condor is a strategy designed to have a substantial probability of earning a little profit when the underlying security is perceived to have low volatility.

So when it comes to iron condors and other options strategies sensitive to volatility, we often see them trade at a discount. Generally speaking, volatility has been relatively high in the last decade.

0 kommentar(er)

0 kommentar(er)